News

Bond Stacking and Principals Obligations Under a Customs Continuous Bond

March 4, 2019 •Avalon

You may have heard of the term “bond stacking” and wondered exactly how does it work? Once a continuous bond is filed and made effective, it will automatically renew every year on its anniversary date until it is terminated. Each year the bond renews, a new period of liability is created up to the bond limit for which the principal and surety are “joint and severally” bound to the United States government for activity covered by the bond.

U.S. Customs bonds provide security to the U.S. Government for payment of duties, taxes and fees as well as compliance with the law and Customs regulations. As such, bonds are subject to different Customs procedures that extend the liability beyond the entry or transaction date. Customs bond claims typically arise much later than when the covered activity took place. Under 28 USC 2415, the statute of limitations CBP has to take action against Customs bonds is six years from the date the right of action accrues, i.e., the date of breach of the bond condition. Due to this, liability under a bond can remain “open” for several years, especially for AD/CVD entries which get suspended indefinitely. Once a continuous bond renews, a new period of liability is open. This creates “stacking” liability that accumulates each year.

The most common Customs bond is the Activity Code 1 continuous import bond. Import bonds are required for importations into the commerce of the United States and guarantee payment of duties, taxes, and fees as well as compliance with import regulations. Each shipment released under an import bond is declared to CBP under the formal process of an entry. Value of shipment, duties, taxes and fees are all declared on an estimated basis at time of entry. Each of these entries then go through a process of final “acceptance” or acknowledgment by CBP, which is called liquidation. Once an entry is liquidated, CBP has 90 days to re-liquidate the entry under 19 USC 1504.

At the time of liquidation or re-liquidation, CBP takes one of the following actions:

- CBP agrees with estimated values, duties, taxes and fees at the time of entry with “no change”

- CBP reviews and determines a refund of duties is due back to the importer

- CBP disagrees with any estimations at time of entry and determines additional duties are due to CBP.

Although the statute of limitations may vary based on the right of action, most sureties may be able to consider the risk to be reduced once liquidation/re-liquidation has taken place. Once all the entries under a bond period are liquidated, the exposure may be reduced for the whole period provided there are no open claims, protests or petitions. Once all the time-frames for any statute of liability have passed, the liability is considered extinguished or exhausted.

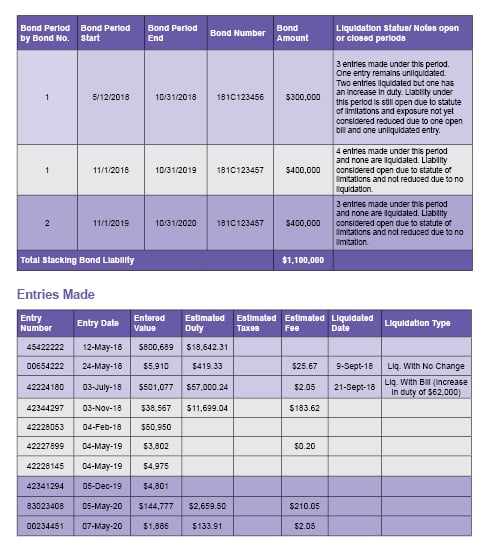

For example, a principal obtains a new continuous bond effective 5/12/2018 and it is terminated before its anniversary on 10/31/2018 as the principal’s activity required a higher limit. A new bond is filed at the higher limit on 11/1/2018 and this bond then renews on its anniversary on 11/1/2019. Entries made under both bonds create three bond periods that “stack” the liability to $1.1M during this time-frame. The example below demonstrates how bond stacking reached $1.1M.

Bond Stacking Example

A principal obtains a new continuous bond effective 5/12/2018 and it is terminated before its anniversary on 10/31/2018 as the principal’s activity required a higher limit. A new bond is filed at the higher limit on 11/1/2018 and this bond then renews on its anniversary on 11/1/2019. Entries made under both of these bonds create three bonds periods that “stack” the liability to $1.1 Million during this time-frame. Below are the sample entry activities showing which entries match each period based on the colors.

Featured Articles

Categories

- ATA Carnet (1)

- Business Insurance (9)

- Canada (1)

- Cargo Insurance (15)

- Claims Corner (10)

- Combined Transit Liability (3)

- Compliance (4)

- Contingent Auto Liability (1)

- Contingent Motor Truck Cargo (1)

- COVID-19 (3)

- Customs Bonds (18)

- Cyber Security (10)

- D&O Insurance (3)

- EPLI (3)

- Events (10)

- General Average (7)

- Industry Insights (25)

- Press Release/Company News (13)

- Special Quest (11)

- TIA (5)

- Trade (22)

- Trade Credit Insurance (2)

- Truck Broker Liability (1)

- WESCCON (4)

The Quest Newsletter is designed to provide critical information in the transportation industry. Avalon Risk Management is not responsible for the accuracy or reliability of information contained in articles. The reader/user assumes all risk in the use of such information.